All Categories

Featured

Table of Contents

As certified financiers, people or entities might partake in private financial investments that are not signed up with the SEC. These investors are assumed to have the monetary refinement and experience needed to evaluate and buy risky financial investment chances unattainable to non-accredited retail investors. Here are a couple of to think about. In April 2023, Congressman Mike Flood presented H.R.

For currently, capitalists must abide by the term's existing meaning. Although there is no official procedure or government qualification to come to be a certified capitalist, an individual might self-certify as an accredited capitalist under current laws if they made even more than $200,000 (or $300,000 with a partner) in each of the past 2 years and anticipate the exact same for the existing year.

People with an energetic Series 7, 65, or 82 license are also thought about to be accredited investors. Entities such as firms, collaborations, and counts on can additionally achieve certified financier status if their financial investments are valued at over $5 million (Accredited Investor Property Portfolios). As accredited financiers, people or entities might participate in personal financial investments that are not signed up with the SEC.

How can Real Estate Crowdfunding For Accredited Investors diversify my portfolio?

Right here are a couple of to consider. Personal Equity (PE) funds have actually shown remarkable development in recent times, relatively undeterred by macroeconomic difficulties. In the 3rd quarter of 2023, PE deal quantity exceeded $100 billion, approximately on the same level with offer task in Q3 of the previous. PE firms swimming pool resources from approved and institutional investors to acquire controlling interests in mature private firms.

In enhancement to capital, angel financiers bring their expert networks, support, and proficiency to the startups they back, with the assumption of venture capital-like returns if business removes. According to the Center for Endeavor Research, the ordinary angel investment quantity in 2022 was about $350,000, with capitalists getting a typical equity risk of over 9%.

That stated, the development of on the internet private credit history platforms and niche enrollers has made the asset class accessible to private certified capitalists. Today, investors with just $500 to spend can make use of asset-based private credit report chances, which use IRRs of as much as 12%. In spite of the rise of e-commerce, physical grocery stores still account for over 80% of grocery store sales in the United States, making themand specifically the realty they operate out oflucrative investments for accredited investors.

In contrast, unanchored strip facilities and community facilities, the following 2 most heavily transacted sorts of property, tape-recorded $2.6 billion and $1.7 billion in transactions, respectively, over the same period. What are grocery store-anchored? Country strip shopping malls, outlet malls, and other retail facilities that feature a major food store as the place's major tenant typically fall under this category, although shopping malls with encased pathways do not.

To a minimal degree, this sensation is additionally true in reverse. This distinctively symbiotic relationship between a center's tenants drives up demand and maintains rental fees raised. Recognized capitalists can purchase these areas by partnering with realty personal equity (REPE) funds. Minimum financial investments commonly start at $50,000, while total (levered) returns vary from 12% to 18%.

Accredited Investor Real Estate Investment Groups

The market for art is likewise expanding. By the end of the decade, this number is anticipated to come close to $100 billion.

Investors can now own diversified personal art funds or purchase art on a fractional basis. These options come with financial investment minimums of $10,000 and provide web annualized returns of over 12%.

If you have actually seen ads for actual estate investments, or any type of various other kind of investing, you may have seen the term "accredited" prior to. Some financial investment opportunities will just be for "approved" financiers which are 506(c) offerings. This leads some individuals to believe that they can not invest in genuine estate when they can (after all, "accredited" seems like something you gain or apply for).

Accredited Investor Real Estate Syndication

Nonetheless, what happens if you intend to purchase a small service? Perhaps there's a restaurant down the road that you intend to buy to get a 25% equity risk. That diner, definitely, will not sign up with the SEC! That's where recognized investing enters play. That restaurant might solicit financial investments from accredited capitalists but not nonaccredited ones.

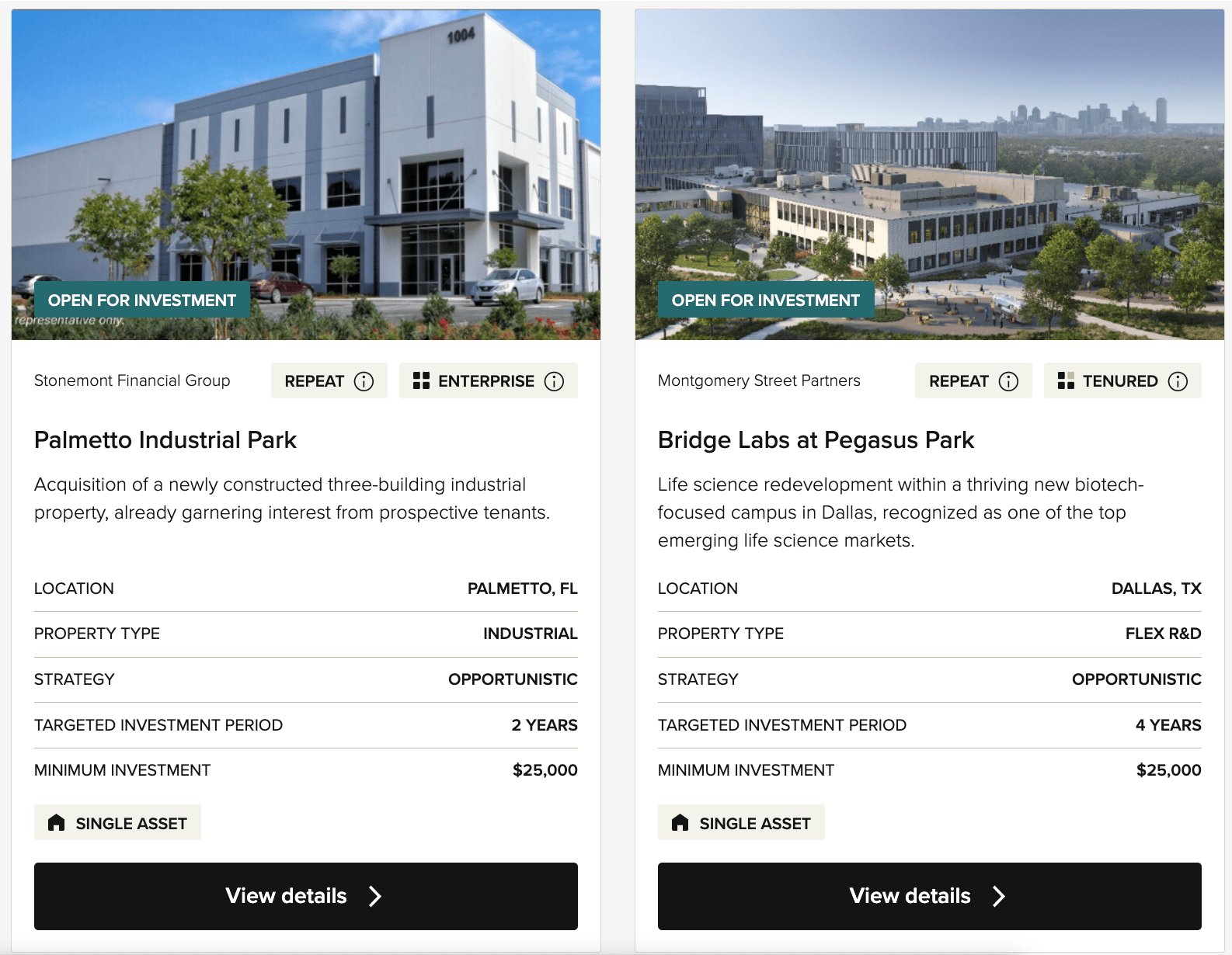

With that history in mind, as you might envision, when somebody obtains capitalists in a new home structure, they have to usually be recognized. Many of them are open to nonaccredited financiers.

A nonaccredited genuine estate financial investment possibility is a 506(b) deal called after the area of the law that authorizes it. Syndications under this legislation can not publicly advertise their safety and securities, so it is called for that the enrollers (people placing the submission together) have a preexisting partnership with the capitalists in the offer.

Maybe the most simple and intuitive financial investment chance for a person who doesn't have accreditation is buying and holding rental building. Usually, property worths value, and you can produce a constant month-to-month earnings stream! Buying and holding rental properties is perhaps the most straightforward of all the unaccredited real estate spending options!

Part of the reason these programs are all over is that flipping does function mostly. You can find homes inexpensively, remodel them, and offer them for a neat profit if you understand where to look. Nonetheless, if you go behind the scenes on these programs, you'll often realize that these investors do much of the service their very own.

Rehab it to make it both rentable and increase the home's value. Refinance the property to draw out as much of your initial funding as feasible.

Who provides reliable Private Real Estate Deals For Accredited Investors options?

What happens if you do not have that conserved up yet however still wish to buy realty? That's where REITs are powerful. Private Property Investment Opportunities for Accredited Investors. REITs are firms that focus on realty and trade on typical stock exchanges. You can buy them in your 401(k) or through any basic broker agent account. These companies typically acquire and run shopping malls, shopping centers, apartment or condo buildings, and various other massive realty financial investments.

Table of Contents

Latest Posts

Default Property Tax

Free Tax Lien Property List

Overage Refund

More

Latest Posts

Default Property Tax

Free Tax Lien Property List

Overage Refund