All Categories

Featured

Table of Contents

As accredited capitalists, individuals or entities may take part in personal financial investments that are not signed up with the SEC. These financiers are assumed to have the economic sophistication and experience needed to review and spend in risky financial investment possibilities inaccessible to non-accredited retail investors. Right here are a few to consider. In April 2023, Congressman Mike Flood presented H.R.

For now, capitalists should comply with the term's existing meaning. There is no official procedure or federal certification to end up being a certified capitalist, an individual may self-certify as a certified investor under current policies if they earned more than $200,000 (or $300,000 with a spouse) in each of the previous two years and expect the exact same for the current year.

Individuals with an active Collection 7, 65, or 82 license are additionally considered to be accredited investors. Entities such as firms, collaborations, and depends on can likewise attain certified financier standing if their investments are valued at over $5 million (Exclusive Real Estate Crowdfunding Platforms for Accredited Investors). As certified financiers, people or entities may participate in exclusive investments that are not signed up with the SEC.

What is the best way to compare Real Estate Investment Funds For Accredited Investors options?

Exclusive Equity (PE) funds have actually shown exceptional growth in current years, relatively undeterred by macroeconomic obstacles. PE companies swimming pool capital from certified and institutional capitalists to obtain regulating rate of interests in mature private companies.

In addition to capital, angel investors bring their specialist networks, advice, and experience to the start-ups they back, with the expectation of venture capital-like returns if the organization removes. According to the Facility for Venture Study, the ordinary angel investment quantity in 2022 was approximately $350,000, with financiers obtaining a typical equity stake of over 9%.

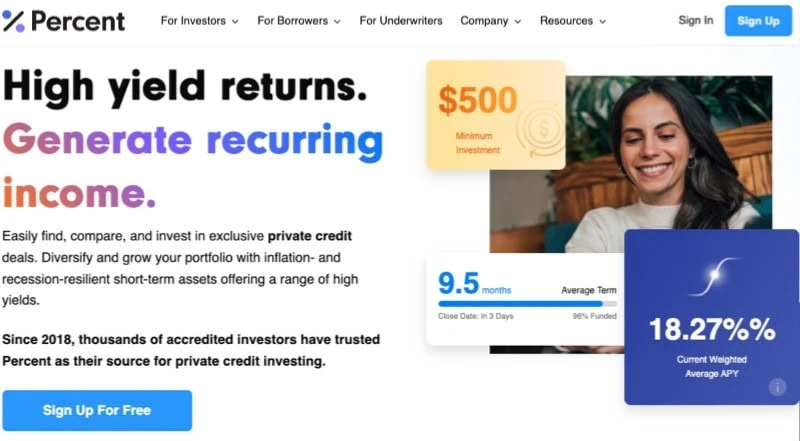

That claimed, the introduction of online personal credit systems and specific niche enrollers has made the possession course available to specific certified investors. Today, investors with just $500 to spend can capitalize on asset-based private debt possibilities, which offer IRRs of approximately 12%. Despite the surge of e-commerce, physical supermarket still account for over 80% of grocery sales in the USA, making themand particularly the property they run out oflucrative investments for certified investors.

In comparison, unanchored strip facilities and area facilities, the next two most heavily negotiated sorts of genuine estate, tape-recorded $2.6 billion and $1.7 billion in purchases, specifically, over the same period. Yet what are grocery store-anchored facilities? Suv strip shopping malls, outlet malls, and various other retail facilities that feature a significant grocery shop as the area's primary lessee commonly fall under this category, although shopping malls with enclosed pathways do not.

Approved investors can invest in these rooms by partnering with real estate private equity (REPE) funds. Minimum investments usually start at $50,000, while complete (levered) returns range from 12% to 18%.

How much do Passive Real Estate Income For Accredited Investors options typically cost?

The market for art is likewise broadening. By the end of the decade, this figure is expected to come close to $100 billion.

Investors can now have varied personal art funds or purchase art on a fractional basis. These alternatives come with investment minimums of $10,000 and provide web annualized returns of over 12%.

If you have actually seen ads for real estate investments, or any other form of investing, you may have seen the term "approved" prior to. Some financial investment opportunities will just be for "accredited" financiers which are 506(c) offerings. This leads some individuals to believe that they can not spend in actual estate when they can (after all, "recognized" seems like something you make or apply for).

How do I apply for Accredited Investor Rental Property Investments?

Nevertheless, what takes place if you wish to purchase a small company? Perhaps there's a diner down the road that you wish to buy to get a 25% equity stake. That restaurant, certainly, will not register with the SEC! That's where accredited investing enters play. That restaurant could solicit investments from recognized investors however not nonaccredited ones.

With that said background in mind, as you could visualize, when somebody solicits investors in a new home structure, they need to typically be approved. Nonetheless, similar to most laws, also that's not always the instance (we'll detail more quickly)! There are several various kinds of real estate investing. Several of them are open to nonaccredited investors (Accredited Investor Rental Property Investments).

A nonaccredited real estate financial investment opportunity is a 506(b) deal called after the section of the statute that authorizes it. Submissions under this regulation can not publicly promote their safety and securities, so it is needed that the sponsors (individuals putting the syndication with each other) have a preexisting partnership with the investors in the offer.

Probably the most uncomplicated and intuitive investment possibility for someone who does not have accreditation is getting and holding rental residential property. Undoubtedly, you don't need any type of unique designation to get the condominium or home down the road and rent it out to occupants. Obviously, that's a good point since buying and holding services is a superb way to develop your total assets! Usually, residential property worths appreciate, and you can develop a consistent regular monthly earnings stream! The only disadvantage is that you're on the hook for anything that goes wrong! And, you need to take care of all your tenants' questions even at 3am or work with a property supervisor to do so (which can come to be pricey, depending on the area). Acquiring and holding rental homes is probably one of the most uncomplicated of all the unaccredited realty spending alternatives! You have actually definitely seen or come across all the flipping programs on TV.

Part of the reason these programs are around is that flipping does work primarily. You can discover homes inexpensively, remodel them, and sell them for a tidy earnings if you know where to look. However, if you go behind the scenes on these shows, you'll typically realize that these investors do a lot of the work with their own.

Rehab it to make it both rentable and enhance the home's value. Refinance the property to draw out as a lot of your first funding as possible.

What does a typical Accredited Investor Real Estate Partnerships investment offer?

What if you do not have that saved up yet however still desire to spend in real estate? These firms generally purchase and run shopping centers, purchasing facilities, apartment or condo buildings, and various other massive real estate investments.

Table of Contents

Latest Posts

Default Property Tax

Free Tax Lien Property List

Overage Refund

More

Latest Posts

Default Property Tax

Free Tax Lien Property List

Overage Refund